American families face mounting financial pressures tied to healthcare. Multiple industry surveys project substantial cost increases for 2025. Mercer’s analysis of over 1,800 employers found healthcare benefit costs per employee will rise 5.8% on average, while Aon projects increases reaching 9% for some plans.

In this environment of escalating expenses, healthcare sharing ministries have attracted those seeking alternatives to tackling healthcare costs. One such ministry, Liberty HealthShare, has distinguished itself within this growing sector by offering six distinct sharing programs rather than forcing members into standardized options.

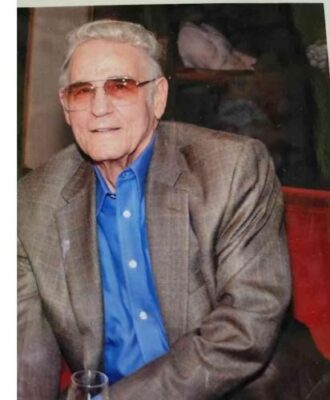

“We’ve got a number of programs so that somebody can select whatever works best for their family,” says Chief Executive Officer Dorsey Morrow.

Industry Context and Growing Appeal

Healthcare sharing ministries now share over $1.1 billion in medical expenses annually among approximately 692,000 members of Alliance-certified organizations. While 107 ministries meet federal certification requirements, only nine maintain large, open membership models, making Liberty HealthShare’s comprehensive program structure notable within the sector.

Liberty HealthShare serves members, employing 165 dedicated team members who process sharing requests and provide member support. The ministry has earned Charity Navigator’s four-star rating and maintains an 88% rating.

Addressing Specific Life Stage Challenges

Healthcare sharing ministries often target healthy populations, but Liberty HealthShare structures programs to serve diverse circumstances. Liberty Rise specifically addresses young adults aged 18-29 who face particular financial pressures during early career years. Recent program adjustments reduced suggested monthly contributions from $122 to $99, effective in May 2025.

“Young adults working part-time while pursuing education or employed without benefits struggle with health insurance premiums that increase annually,” Morrow notes. Industry data supports this concern, with reports indicating that private health insurance premiums have risen for four consecutive years.

Liberty HealthShare member Antonio Monterrosa was familiar with these rising costs. After confronting $3,400 monthly insurance costs for his family, he switched to the health sharing ministry. When emergency surgery resulted in $8,000 in medical bills, “it was all shared by our fellow Liberty HealthShare members,” he recalled.

Liberty Assist addresses Medicare beneficiaries aged 65 and older with Parts A and B coverage. Suggested monthly contributions begin at $87, providing supplemental support for Medicare’s coverage gaps, particularly relevant as employer healthcare costs push more retirees toward fixed-income challenges.

Liberty Freedom serves adults 35 and younger seeking catastrophic protection without comprehensive sharing. Rising healthcare costs particularly impact young families balancing mortgage payments, student loans, and healthcare expenses, pressures reflected in industry cost projection data.

Member feedback directly shaped Liberty HealthShare’s dental sharing program development, demonstrating responsive program expansion contrasting with insurance industry standardization. “Every six months, we survey our members asking about emerging needs, and one of them was the dental program, which we launched,” Morrow explains.

Liberty Dental shares up to $2,000 in eligible expenses annually, with suggested monthly contributions beginning at $35. Provider choice freedom extends to dental care, maintaining Liberty HealthShare’s philosophy of member autonomy over healthcare decisions.

Core Program Structure: Unite, Connect, and Essential

While industry consolidation reduces insurance options, Liberty HealthShare operates three primary sharing programs with different co-responsibility structures. Liberty Essential includes 25% co-sharing after Annual Unshared Amounts, Liberty Connect requires 15% co-sharing, while Liberty Unite eliminates member responsibility beyond initial thresholds.

Members can utilize any healthcare provider they wish, offering significant freedom as insurance market concentration reduces provider choice. Liberty HealthShare’s approach contrasts with network restrictions, which the Government Accountability Office identifies as contributing to reduced competition and higher costs.

Multi-vendor cost negotiation distinguishes Liberty HealthShare’s approach from single-payer insurance models. “We don’t use just one or two vendors to help us negotiate with medical providers on behalf of our members,” Morrow explains. “We’ve got three or four various vendors, and each has specific tasks helping us identify problem areas.”

Faith-Based Community Support

Liberty HealthShare integrates prayer support into member services. Weekly prayer request distribution connects the ministry’s 165 team members with member needs, with the goal of fostering meaningful spiritual connection.

“We have a list distributed internally every Friday of prayer requests from our members,” says Morrow. “Whether it’s with the member or for the member, we are about prayer. We strongly believe in that here.”

Members submit prayer requests through ShareBox, Liberty HealthShare’s secure online portal where they track contribution impact and manage sharing experiences.

Member-First Philosophy

Liberty HealthShare maintains operational transparency through publicly available guidelines, financial reports, and board information.

“Anything and everything you want to know about Liberty HealthShare, you can go to our website,” Morrow states. “You’ll see we are an open book. You can find our 990. You can find our guidelines. You can find our audit report.”

Year-round enrollment allows program transitions without waiting periods, flexibility unavailable in healthcare models with limited enrollment periods. Members can modify or discontinue programs as circumstances change, reflecting Liberty HealthShare’s emphasis on member autonomy over restrictive contracts.

“Our focus at Liberty HealthShare is on our members,” Morrow concludes. “We are not driven by profit. It’s frankly our goal to go broke each month. The contributions coming in should be the contributions that go out.”