The Families First Coronavirus Response Act, or House Resolution 6201, was recently signed into law by President Donald Trump and is set to take effect April 1.

This is the second piece of legislation to address the COVID-19 coronavirus, and the first to provide a major benefit expansion, including emergency paid sick leave, emergency family medical leave and tax credits, among others. The law is set to apply to businesses with fewer than 500 employees, with some exceptions, and expire Dec. 31.

There are a lot of provisions attached to this bill, so here’s a breakdown of some of those provided by attorney Brian Koegle of Poole Shaffery & Koegle, LLP:

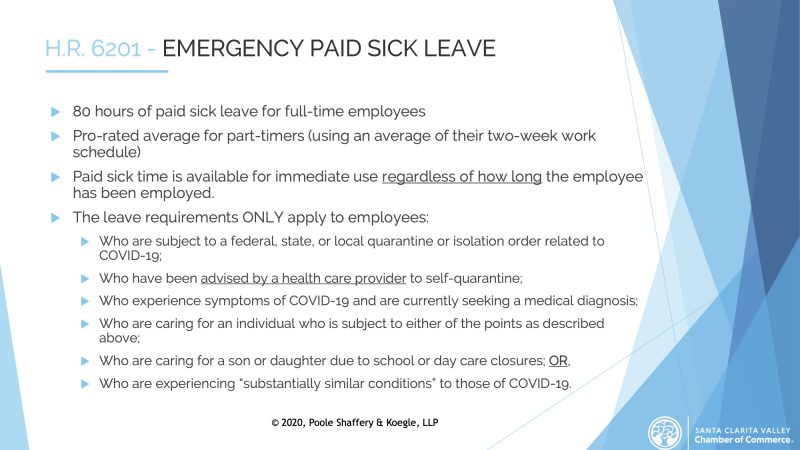

Emergency paid sick leave

The law is set to provide full-time employees 80 hours of paid sick leave, while part-timers receive a prorated average of their typical work schedule.

This time is expected to be available for immediate use, regardless of how long an employee has been employed at a company.

It applies only to employees who:

- Are subject to federal, state or local quarantine or have been ordered into isolation due to a positive result for COVID-19.

- Have been advised by a health-care provider to self-quarantine.

- Are experiencing symptoms of COVID-19 and are currently seeking a medical diagnosis.

- Are caring for an individual who is subject to any of the points as described above.

- Are caring for a son or daughter due to school or daycare closures.

- Are experiencing “substantially similar conditions” to those of COVID-19.

“Please note … this doesn’t mean that you can take care of yourself for two weeks, and then if a family member becomes ill, you take an additional two weeks,” Koegle said.

Those who fall under the first three bullet points are entitled to 100% of their regular rate of pay during the time they are away, while those who fall under the last three bullets are entitled to two-thirds of their regular rate of pay. These individuals are to be paid by the employer.

“Individuals who draw much of their income from commissions, bonuses, or performance-driven incentives, their regular rate of pay will take into consideration those calculations,” he added.

Emergency family and medical leave

“As part of the general Family Medical Leave Act under federal law, an employer has to provide job-protected leave for up to 12 weeks for an individual to care for their own serious health condition or the serious health condition of an immediate family member,” Koegle said.

Under the new law, Congress has decided to expand the provisions of the FMLA to include leave associated with COVID-19, though employers with 50 or fewer employees can apply for exemptions from this provision.

Only employees who have been employed with a company for 30 consecutive days prior to taking leave are eligible.

“It is intended to apply only to those employees who cannot work, or perform telework (basically work from home) because their minor child’s school or child-care service is closed due to a public health emergency,” Koegle added.

The first 10 days of this leave are unpaid, though an employee, while not required to, can use their sick leave, vacation or paid time off. For the following 10 weeks, employees should be paid two-thirds of their regular rate of pay, up to $200 per day with a cap of $10,000 total.

Tax credits

“Employers are going to receive a payroll tax credit to help offset the cost of these leaves,” Koegle added. “That means that as long as you have benefits that you’re paying to your employee, you could deduct that from your monthly payroll taxes that you would be submitting.”

There are limits to these tax credits, which are:

- Up to $511 per day for an employee’s own sickness or self-isolation.

- Up to $200 per day to care for a child after a school or child-care closure or an ill family member.

“We do not yet have guidance on the process for credit processing and reporting to the government to ensure that there is no fraud,” Koegle said.

To view all coronavirus-related stories, visit signalscv.com/category/news/coronavirus.